Beyond the Beats: A Deep Dive into Spotify’s Growth and Strategy

Spotify has experienced rapid growth and success over recent years, establishing itself as the dominant player in the music streaming industry. With impressive stock performance, subscriber growth, and an expanding array of services, Spotify is poised to continue shaping the future of digital music. This article provides an in-depth look at the company’s financial health, competitive edge, risks, and future growth opportunities, while focusing on the strategies that will help the company maintain its position in the years to come.

Setting the Stage: Spotify’s Journey and Market Position

Founded in 2006, Spotify has become a global leader in music streaming, securing a 34.8% market share in 2022. However, the company’s journey has not been without challenges. Spotify faces stiff competition from major players such as Apple Music, Amazon Music, and YouTube Music, each of which offers similar services to capture market share. While Spotify maintains its dominance, the company must continue to evolve and differentiate itself to stay ahead. To do so, Spotify has invested heavily in podcasts, audiobooks, and exclusive content, expanding its offerings and solidifying its position in a rapidly growing and competitive market.

The Numbers Behind the Music: Financial Highlights and Performance

Spotify’s financial results in recent quarters reveal a healthy and growing business model. In Q3 2024, Spotify reported a 19% year-over-year revenue increase, reaching €3.99 billion (approximately $4.24 billion USD). The company’s operating income surged to €454 million ($483 million USD), a significant rise from €32 million ($34 million USD) in the same period the previous year. These numbers highlight Spotify’s effective cost management and its ability to generate increased revenue while keeping expenses under control.

Spotify’s subscriber base also continues to grow, with the company reporting 640 million monthly active users (MAUs) and 252 million premium subscribers. This represents an 11% increase in MAUs year-over-year, with projections for Q4 2024 suggesting 665 million MAUs and 260 million premium subscribers. These figures reflect strong user engagement and the company’s ability to attract new customers while retaining existing ones.

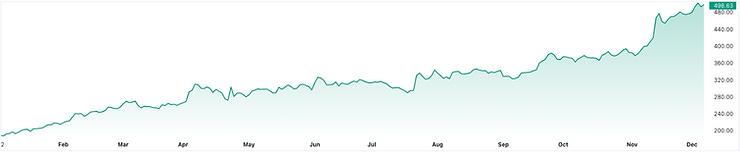

As of December 8, 2024, Spotify’s stock price reached $498.63, reflecting a market capitalization of approximately $97 billion. The company’s high P/E ratio of 123.60 and P/S ratio of 5.61 suggest that investors have strong confidence in Spotify’s growth prospects, despite the competitive challenges it faces.

Hitting the Right Notes: Evaluating Spotify’s Performance

Spotify’s growth is not just measured by its increasing revenue and subscriber count but also by its ability to maintain strong financial health in a competitive market. In Q3 2024, Spotify reported a record-high gross margin of 31.1%, driven by increased profitability and operational efficiency. Additionally, the company exceeded analysts’ expectations with €711 million ($750 million USD) in free cash flow for the quarter. These results demonstrate Spotify’s strong financial position and its ability to generate cash flow even amid a competitive landscape.

However, Spotify faces several challenges moving forward. One major obstacle is the high royalty payments the company allocates to music rights holders, which can impact profitability. These payments are a necessary part of Spotify’s business model, but they limit the company’s margin flexibility. Additionally, Spotify must contend with the intensifying competition from Apple Music, Amazon Music, and other streaming services. The competition is not only about user acquisition but also about differentiating the service and continuously improving its offerings to retain market leadership.

A Streamlined Experience: Spotify’s Competitive Edge

Spotify’s success in the music streaming market is largely attributed to its unique competitive advantages. The platform offers an extensive music library, a range of personalized playlists, and a highly intuitive user interface that makes it easy for users to discover new content. Spotify's ability to analyze user data and offer tailored recommendations sets it apart from competitors, keeping users engaged and loyal to the platform.

Moreover, Spotify has focused on building strong partnerships with artists, record labels, and podcasters to provide exclusive content to its users. These partnerships, along with Spotify’s commitment to offering unique features like Spotify Originals and early access to music, enhance its value proposition and differentiate it from other streaming services. However, as competition intensifies, Spotify must continue innovating to stay ahead of the curve and retain its competitive edge.

Storm Clouds Ahead? Key Risks Spotify Must Navigate

Despite its success, Spotify is not without its risks. One of the most significant risks the company faces is its reliance on royalty payments, which take up a substantial portion of its revenue. As Spotify continues to grow, so does the cost of these payments, which could put pressure on the company's profitability if it is unable to grow revenue fast enough to offset these costs.

Another risk is the fierce competition from other streaming platforms, particularly Apple Music, Amazon Music, and YouTube Music. These platforms benefit from their own ecosystems and large user bases, which allow them to cross-sell and bundle their music services with other offerings. To stay competitive, Spotify must continue to differentiate itself through exclusive content, user-centric features, and a broader content strategy that extends beyond music into podcasts, audiobooks, and other media.

Dominating the Airwaves: Spotify’s Position in the Streaming Market

Spotify holds a dominant position in the global streaming market. As of 2022, it had a market share of 34.8%, a leading position in a sector that is growing rapidly. The company has continued to expand its user base, diversify its content offerings, and innovate in response to shifting consumer demands. Spotify’s strategic shift toward podcasts and audiobooks further strengthens its position, allowing the company to tap into new, lucrative markets and engage users in ways that go beyond traditional music streaming.

However, to maintain its leadership, Spotify must continue innovating and enhancing its platform. Expanding into emerging markets with tailored content offerings, improving user experience, and fostering strategic partnerships will be critical to sustaining its market dominance.

The Road Ahead: Spotify’s Strategic Path to Long-Term Growth

Spotify’s future growth lies in several strategic initiatives aimed at boosting its premium subscriber base, expanding its content, and capitalizing on emerging market opportunities.

One of the primary growth strategies for Spotify is converting its large free user base into paying subscribers. With more than 600 million users on the platform, Spotify has a vast pool of potential customers. Increasing the conversion rate of free users will be essential for driving revenue growth. To encourage this shift, Spotify needs to enhance the appeal of its premium offerings, making them feel indispensable.

To achieve this, Spotify must continue to invest in exclusive content, such as podcasts, early releases from popular artists, and premium-only features. Providing a unique, premium experience will ensure that users see the value in upgrading to a paid account.

Additionally, Spotify can explore pricing models like family plans, student discounts, and even ad-supported low-cost premium tiers to appeal to a broader audience. Expanding into emerging markets with region-specific pricing and marketing will also be a key part of Spotify’s growth strategy, allowing the company to reach more users in developing regions.

Long-Term Profitability: Ensuring Spotify’s Sustainable Success

While increasing the number of paying subscribers is critical to Spotify’s growth, it must also ensure that its business model is sustainable over the long term. This involves managing the costs associated with licensing, royalties, and content creation, which can eat into profit margins. Spotify’s long-term success will depend on its ability to balance user growth with profitability, maintaining healthy margins while continuing to innovate and expand its offerings.

This is not financial advise, but I would advise against opening a position in $SPOT. Pushing $500 per share is very overvalued in my opinion, and regardless of wether or not they are able to convert free users to paying, there is always the chance Apple start investing heavily into Apple Music.

Spotify are a leader in music streaming, but that does not mean they'll stay that way forever. Apple and Amazon's respective music streaming platforms have the benefit of multi-trillion dollar companies backing them, and if they wanted to get serious, they could annihilate Spotify in less than a decade.